London, United Kingdom (January 26, 2023) Colmore, a Preqin company and leading service and technology provider for private market Limited Partners and allocators, today announces the launch of HELIOS 3.0, the most ambitious release yet to their real-time portfolio monitoring platform, designed for private market portfolios.

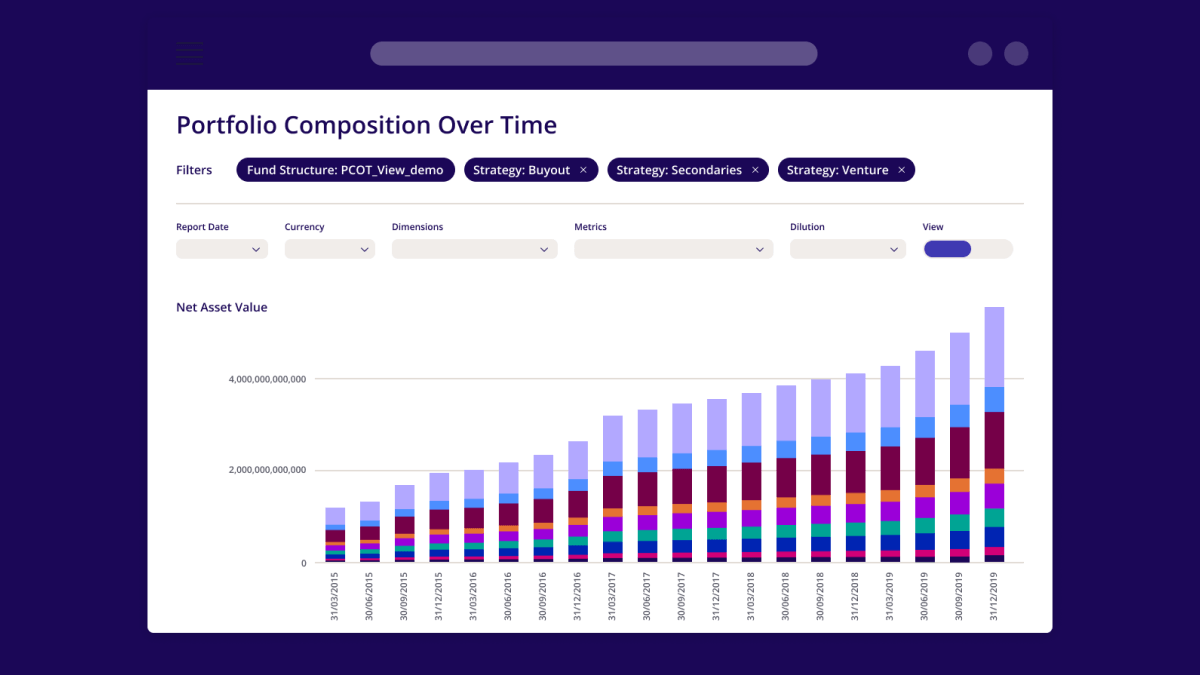

HELIOS 3.0, delivers new features and functionality that bring unparalleled transparency, flexibility and control to private market investors, and it’s driven by a brand-new investment data model.

Transparency has always been at the heart of Colmore’s approach to Portfolio Monitoring, and has been a core feature of HELIOS since its inception, giving investors the ability to pierce through to the allocations and investments that drive their value underneath that top-line capital account or NAV provided by their GPs. With the introduction of Fund Look Through, investors are empowered to create customized views of their portfolio right down to the individual investment; the calculation basis of a given view can be selected and portfolio views can be saved, analysed and shared within the platform. Ultimately, investors are in full control of their analytics.

Power BI has been integrated within the platform enabling even more custom reporting, and custom calculations, balances and client-defined metrics can be applied directly to the HELIOS front-end with the introduction of a no-code calculation engine. This means custom calculations can be applied quickly and easily and deployed in real-time.

HELIOS 3.0 also brings further integration with Preqin with the introduction of Fund and Holdings-level performance benchmarking. Fund performance can now be measured against a database of thousands of Preqin’s private market benchmarks including Preqin’s new deal-level benchmarks, which enable performance analysis of the underlying holdings and give insight into the ultimate drivers of value within a portfolio.

Ben Cook, CEO, at Colmore says, “Colmore was founded on transparency. With HELIOS 3.0, we’re able to demonstrate the innovative thinking that has helped us be at the leading edge of portfolio monitoring in private markets. Not only can clients see more granular performance and attribution, they can also see that data in context, by utilizing some of the most well used benchmarks in our industry. I am delighted with the work our teams have done to really understand client needs and bring this new functionality to life.”

Colmore, which was acquired by alternatives data and insights provider Preqin in 2021, has been continuously dedicated to expanding its product and service capabilities through strategic hires, focus on product innovation and expansion into APAC. Colmore continues to centre on supporting its clients, developing its people and operations, as well as strengthening existing relationships within the industry. What is more, by working closely with Preqin, the firm ultimately aims to support its clients across the entire investment lifecycle.

About Colmore

Colmore, A Preqin Company, is a market-leading, technology-driven private markets investor services business focused on the Limited Partner and Allocator market. The business operates from five offices located in New York and Dallas in the US, London and Birmingham in the UK and Singapore. Colmore employs more than 260 professionals, with the business monitoring over 4,500 private market funds and 40,000+ holdings.